Looking ahead to 2023: The only guaranteed change is change itself

The past few years have seen unprecedented changes in Financial Services networking and IT. No one knows exactly what 2023 holds, but we do know that every business must be ready to adapt.

Heading into 2023, there are three key steps financial service companies must take:

- Improve application performance and strengthen security for remote and mobile employees

- Be careful to not over architect networks to the point where they’re paying for capacity they’re not using

- Do not under architect networks to the point where they can’t support peak-demand requirements

2023 Trends

Proliferation of digital apps

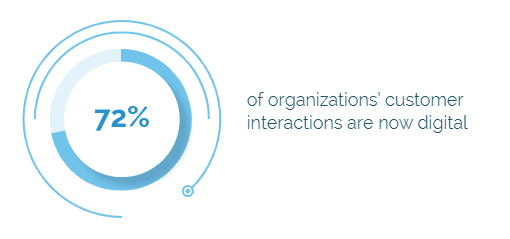

According to MuleSoft’s 2022 Connectivity Benchmark Report, 72% of organizations’ customer interactions are now digital. Today’s financial enterprises must ask themselves…

- What technology will ensure optimal application performance without increasing complexity?

- Which services best support today’s bandwidth intensive, latency-sensitive digital applications?

- What technology will ensure optimal application performance without increasing complexity?

- Which services best support today’s bandwidth intensive, latency-sensitive digital applications?

Rise in cyber crime

The average cost of a data breach (according to the latest report by IBM and the Ponemon Institute) has increased to $4.35 million — a 13% increase from 2020.

When remote work was involved, the average breach cost was $1 million higher, and it took longer to contain the breach than when the breach occurred onsite.

The report also showed that the financial sector has the second highest cost for data breaches ($5.97 million per breach, trailing only healthcare). Compromised credentials were responsible for 20% of all breaches. Zero Trust strategies reduced the cost of a breach by $1 million, and AI-powered and automated security strategies reduced costs by 65%.

Move to multicloud networks

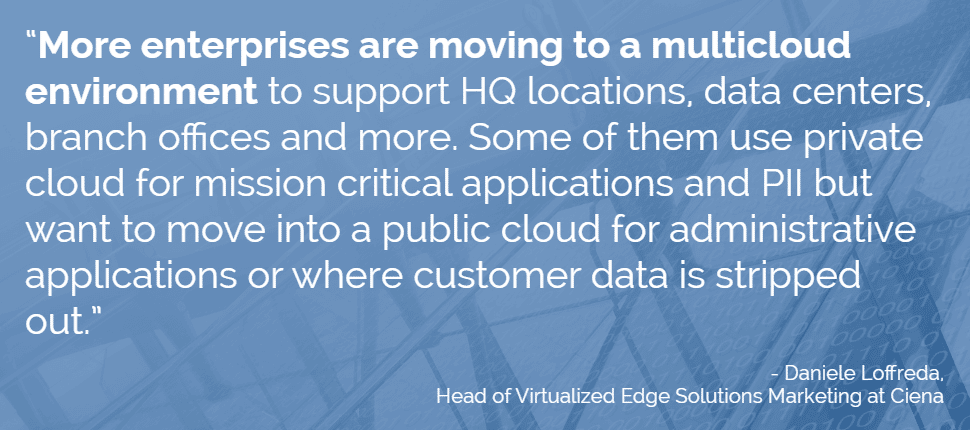

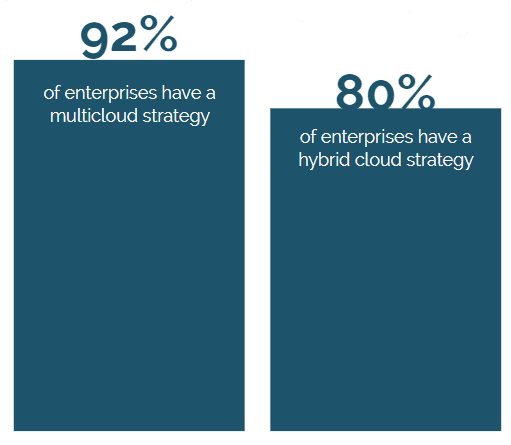

According to Flexera’s 2021 State of the Cloud report, 92% of enterprises have a multicloud strategy — 80% have a hybrid cloud strategy. The report also found that businesses are using, on average, 2.6 public clouds and 2.7 private clouds. While financial and banking sectors tend to lag in technology adoption, 91% of financial institutions are actively using cloud services or plan to in the next 6-9 months. This multicloud and hybrid cloud strategy provides the performance and security adaptability and flexibility that enterprises need in today’s hyperconnected environment — this is especially true for financial institutions that are finding the limits and liabilities of public clouds. According to Daniel Loffreda, Head of Virtualized Edge Solutions Marketing at Ciena, “More enterprises are moving to a multicloud environment to support HQ locations, data centers, branch offices and more. Some of them use private cloud for mission critical applications and PII but want to move into a public cloud for administrative applications or where customer data is stripped out.”

What are the top priorities for 2023?

- Establish bandwidth capacity that delivers high-level application performance while adapting to fluctuating bandwidth needs

- Decrease costs by looking for the highest capacity and performance at lower costs

- Reduce complexity by allowing IT staff to support applications instead of network management

- Improve flexibility by improving an organization’s ability to quickly scale to meet business requirements

- Ensure secure application access for employees working remote, onsite or via mobile

Benefits of working with WIN Technology

WIN’s network is built on wholly owned fiber assets along with industry leading Ciena technology. This provides scalable, flexible, high-capacity data transport and protects mission-critical traffic.

We partner with Ciena, who has served banks, fintech, trading firms and more for decades. This collaboration helps drive research and development for the evolution of optical packet and virtualized networking for the financial services networks of the future.

To learn more about WIN Technology and how we partner with our financial services customers, contact us for a no-obligation consultation or email us at [email protected].